Invest in Open Plots in 2025 Is Not A Good Idea ?

Is It Right to Invest in Open Plots in 2025? Exploring the Pros, Cons, and Alternatives

Investing in real estate has always been a popular choice for individuals looking to grow their wealth. Among the various options available, open plots have gained significant attention in recent years. But as we approach 2025, the question arises: Is it right to invest in open plots in 2025? In this article, we’ll delve into the advantages, disadvantages, and alternatives to investing in open plots, helping you make an informed decision.

Is It Right To Invest in Open Plots in 2025

Why Consider Investing in Open Plot in 2025?

1. Appreciation Potential

One of the primary reasons to invest in open plot in 2025 is their potential for appreciation. As urbanization expands, the demand for land in developing areas increases. Open plots in strategic locations, such as near highways, IT hubs, or upcoming infrastructure projects, are likely to see significant value appreciation over time.

2. Flexibility in Usage

Unlike constructed properties, open plots offer flexibility. You can use the land for building a home, starting a business, or even holding it as a long-term investment. This versatility makes open plots an attractive option for investors.

3. Lower Maintenance Costs

Compared to residential or commercial properties, open plots require minimal maintenance. There’s no need to worry about repairs, renovations, or tenant management, making them a hassle-free investment.

4. Tax Benefits

Investing in open plots can also offer tax benefits. In many countries, land investments are subject to lower tax rates compared to other real estate assets. Additionally, long-term capital gains tax exemptions may apply if you hold the property for a certain period.

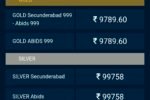

Today gold rate in Hyderabad Begum Bazar Live ( February 03.2025 )

Challenges of Investing in Open Plots in 2025

While there are several advantages, it’s essential to consider the challenges before you invest in open plots in 2025.

1. Market Volatility

The real estate market is subject to fluctuations. Economic downturns, changes in government policies, or oversupply of land can impact the value of open plots.

2. Lack of Liquidity

Open plots are not as liquid as other investments like stocks or mutual funds. Selling a plot of land can take time, especially if the market is slow.

3. Legal Risks

Investing in open plots comes with legal risks, such as disputes over land ownership, unclear titles, or zoning restrictions. It’s crucial to conduct thorough due diligence before making a purchase.

4. No Immediate Returns

Unlike rental properties, open plots do not generate immediate income. You’ll need to wait for the land to appreciate or develop it to see returns, which can take years.

Alternatives to Investing in Open Plot in 2025

If you’re unsure whether to invest in open plot in 2025, consider these alternatives:

1. Residential Properties

Investing in residential properties, such as apartments or villas, can provide steady rental income and long-term appreciation. This option is ideal for those looking for immediate returns.

2. Commercial Real Estate

Commercial properties, like office spaces or retail outlets, offer higher rental yields compared to residential properties. However, they require a larger initial investment and come with higher risks.

3. Real Estate Investment Trusts (REITs)

REITs allow you to invest in real estate without owning physical property. They offer liquidity, diversification, and regular dividends, making them a great alternative to open plots.

4. Agricultural Land

Agricultural land can be a profitable investment, especially in regions with high demand for farming or organic produce. However, it requires knowledge of the agricultural sector and may involve higher maintenance costs.

5. Stocks and Mutual Funds

If you’re looking for a more liquid and diversified investment, consider stocks or mutual funds. While they don’t involve physical assets, they can provide higher returns over the long term.

Key Factors to Consider Before Investing in Open Plot in 2025

Before you decide to invest in open plot in 2025, keep the following factors in mind:

1. Location

The location of the plot is the most critical factor. Look for areas with upcoming infrastructure projects, good connectivity, and high growth potential.

2. Legal Verification

Ensure the plot has a clear title, no legal disputes, and complies with local zoning laws. Hire a legal expert to verify the property documents.

3. Budget and Financing

Determine your budget and explore financing options if needed. Keep in mind additional costs like registration fees, taxes, and development charges.

4. Future Development Plans

Research the area’s future development plans, such as new highways, airports, or industrial zones. These factors can significantly impact the plot’s value.

5. Exit Strategy

Have a clear exit strategy in place. Whether you plan to sell the plot after a few years or develop it, knowing your end goal will help you make better decisions.

The Right Time to Start Investing in Stocks; Stop Getting Fooled

Conclusion: Should You Invest in Open Plots in 2025?

Investing in open plots in 2025 can be a lucrative opportunity if done wisely. The potential for appreciation, flexibility, and lower maintenance costs make it an attractive option for long-term investors. However, it’s essential to weigh the risks, such as market volatility and legal challenges, before making a decision.

If you’re unsure about investing in open plots, consider alternatives like residential properties, REITs, or agricultural land. Each option has its pros and cons, so choose one that aligns with your financial goals and risk tolerance.

Ultimately, the decision to invest in open plots in 2025 depends on your individual circumstances, market research, and long-term vision. By carefully evaluating your options and seeking professional advice, you can make a sound investment that yields significant returns in the future.