The Right Time to Start Investing in Stocks; Stop Getting Fooled

A Reality Check for the Social Media Generation

The Right Time to Start Investing in Stocks In today’s fast-paced, social media-driven world, the allure of quick wealth and financial freedom has never been more tempting. Platforms like Instagram, YouTube, and Telegram are flooded with influencers promoting the idea that the stock market is a golden ticket to riches. Many Indian influencers are creating Telegram groups, charging hefty fees, and luring people—especially those without stable incomes—into the world of stock trading. But is this the right time to start investing in stocks for everyone? Let’s dive deep into the reality of stock market investing and understand why having extra money, not desperation, should be your guiding principle.

The Social Media Hype: A Dangerous Illusion

The rise of social media has democratized information, but it has also created a breeding ground for misinformation. Influencers often showcase their luxurious lifestyles, claiming that their success stems from stock market investments. They create Telegram groups, charge fees, and promise insider tips to help you “get rich quick.” However, what they don’t show are the risks, losses, and the fact that most of their income comes from selling courses or memberships, not from trading.

For many young Indians, especially those without stable incomes, this hype can be dangerously misleading. The idea of the right time to start investing in stocks is often misinterpreted as “right now,” fueled by FOMO (fear of missing out). But investing in stocks without a solid financial foundation or extra money to spare can lead to significant losses and financial stress.

The Right Time to Start Investing in Stocks: When You Have Extra Money

The right time to start investing in stocks is not when you’re influenced by social media trends or peer pressure. It’s when you have more money than you need for your essential expenses, emergency fund, and other financial goals. Here’s why:

- Stocks Are Not a Get-Rich-Quick Scheme: If investing in stocks could make everyone rich overnight, billionaires like Elon Musk or Mukesh Ambani would have chosen the stock market over building industries like Tesla or Reliance. The truth is, the stock market is a tool for wealth creation over the long term, not a shortcut to instant riches.

- Risk and Volatility: The stock market is inherently volatile. Prices fluctuate daily, and short-term losses are common. If you’re investing money you can’t afford to lose, the emotional toll of seeing your portfolio dip can lead to panic selling and poor decisions.

- Long-Term Perspective: The right time to start investing in stocks is when you can commit to a long-term strategy. Historically, the stock market has delivered solid returns over decades, but it requires patience and discipline. If you’re investing money you might need in the near future, you’re setting yourself up for failure.

- Financial Stability First: Before diving into stocks, ensure you have a stable income, an emergency fund (covering 6-12 months of expenses), and no high-interest debt. Investing should be a step you take after securing your financial foundation.

Why Extra Money Matters in Stock Investing

Having extra money to invest means you’re not relying on the stock market to pay your bills or fund your lifestyle. It allows you to take calculated risks without jeopardizing your financial security. Here’s how to determine if you have “extra money” to invest:

- Calculate Your Monthly Expenses: Track your income and expenses to understand how much you can save.

- Build an Emergency Fund: Set aside money for unexpected expenses like medical emergencies or job loss.

- Pay Off High-Interest Debt: Credit card debt or personal loans can erode your wealth faster than the stock market can grow it.

- Set Financial Goals: Whether it’s buying a house, saving for education, or planning for retirement, align your investments with your goals.

Once you’ve covered these bases, any surplus money can be considered “extra” and used for investing in stocks.

Unbelievable Earnings: Street Businesses in India That Exceed Expectations

The Role of Social Media Influencers: A Word of Caution

While some influencers provide valuable insights, many are motivated by profits from courses, memberships, or affiliate marketing. Joining a Telegram group or paying for stock tips is not a substitute for financial education. Instead of blindly following influencers, take the time to learn the basics of investing:

- Understand Stock Market Fundamentals: Learn about concepts like diversification, risk management, and valuation.

- Start Small: Begin with index funds or ETFs, which offer broad market exposure with lower risk.

- Avoid Emotional Decisions: Don’t let social media hype or market volatility dictate your actions.

Conclusion: The Right Time to Start Investing in Stocks Is When You’re Ready

The right time to start investing in stocks is not when social media influencers tell you to, but when you’re financially prepared. It’s when you have extra money, a stable income, and a clear understanding of the risks involved. Remember, the stock market is not a magic wand that can turn everyone into a billionaire. It’s a tool for building wealth over time, and it requires patience, discipline, and a solid financial foundation.

In a world where influencers are constantly pushing the narrative of quick riches, it’s crucial to stay grounded and make informed decisions. Don’t let the allure of social media fame cloud your judgment. The right time to start investing in stocks is when you’re ready—not when someone else tells you to be.

By focusing on financial stability, educating yourself, and investing only what you can afford to lose, you’ll be better positioned to navigate the stock market and achieve your long-term financial goals. So, before you join that Telegram group or buy that expensive course, ask yourself: Is this really the right time to start investing in stocks for me?

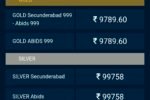

Check Live stock market Reports here