Gold loan from Bank ? 7 things to no before taking loan

7 Crucial Things to Know Before Taking a Gold Loan from Bank

When I needed urgent funds last year, I considered several loan options but ultimately chose a gold loan from bank. The process seemed straightforward, but I learned several important lessons along the way that I wish I knew beforehand. If you’re thinking about getting a gold loan from bank, here are seven crucial factors to consider based on my personal experience.

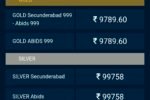

Today Gold Rate In Hyderabad live (Sonawale.com) 22k, 24k, Silver Prices

1. Understand How Gold Valuation Works

Banks don’t lend against the market price of your gold jewelry. They consider:

- Purity: Only 18-22 karat gold gets maximum valuation

- Weight: After deducting stone weight (if any)

- Current gold prices: Check rates for 1-2 weeks before applying

Pro Tip: Gold prices fluctuate daily. Monitor prices for a week before your loan application. I got 8% more loan amount simply by waiting for a price spike.

2. Compare Interest Rates Across Banks

Not all gold loans from banks have the same interest structure. Compare:

- Base interest rates (typically 7-15% p.a.)

- Processing fees (0.5-2% of loan amount)

- Prepayment charges (some banks charge none)

- Insurance costs (usually 0.5-1% annually)

I saved ₹12,000 by choosing a bank that offered 0.5% lower interest and no processing fee.

3. Know the Loan-to-Value (LTV) Ratio

RBI mandates maximum 75% LTV for gold loans from banks. This means:

| Gold Value | Maximum Loan (75% LTV) |

|---|---|

| ₹1,00,000 | ₹75,000 |

| ₹2,00,000 | ₹1,50,000 |

| ₹5,00,000 | ₹3,75,000 |

Warning: Some banks may offer higher LTV through unofficial channels. Avoid these as they violate RBI norms and put your gold at risk.

4. Required Documents for Gold Loan

When I applied for my gold loan from bank, these documents were mandatory:

- Identity Proof (Aadhaar, PAN, Voter ID, or Passport)

- Address Proof (Utility bill or Rental agreement)

- Passport-size photographs (2-4 copies)

- Gold ornaments (with original purchase bills if available)

Surprisingly, income proof wasn’t required since the loan is secured against gold.

5. What to Do Before Visiting the Bank

Prepare properly to save time and get better terms:

- Clean your gold: Remove dirt and separate non-gold items

- Take photos: Document all pieces you’re pledging

- Check purity: Get a certificate from a local jeweler if unsure

- Calculate needs: Borrow only what you require, not maximum available

6. Documents to Collect After Loan Settlement

After repaying my gold loan from bank, I made sure to collect:

- Loan closure certificate (most important)

- No dues certificate

- Receipt for gold return

- Original gold ornaments (check weight and purity)

- Updated passbook/statement showing zero balance

Critical: Verify your returned gold matches what you pledged. I found a 0.5g discrepancy which the bank corrected after showing my pre-loan photos.

7. Alternatives to Consider Before Gold Loan

While gold loans from banks are convenient, explore other options:

- Personal loans: Better if you need funds for longer tenure

- Credit cards: Suitable for smaller, short-term needs

- Relatives/friends: May offer interest-free options

I realized that for needs beyond 1 year, a personal loan would have been cheaper despite higher interest, because gold loans typically have shorter tenures.

Final Thoughts

A gold loan from bank can be an excellent solution for immediate financial needs, but only if you understand all aspects. From my experience, the keys are:

- Time your application with gold price peaks

- Compare at least 3-4 banks

- Maintain proper documentation throughout

- Plan your repayment strategy in advance

By following these guidelines, you can make your gold loan from bank experience smooth and cost-effective, just like I eventually did after learning these lessons the hard way.